The Big Picture of Personal Finance

The truth is our journey here started nearly a decade ago, and the detailed planning of this life started five years ago, and it wasn’t even really within the realm of possibility until three years ago. But everything up to now has happened because of thoughtful daily planning.

This is going to be a long one. Clear your appointments, close the door, and sneak out the alcohol.

I know we're not a personal finance publication, but it would be unfair to portray our lives to you as though we didn’t put in any planning or saving. That we are living completely on a whim from a financial windfall, inheritance, or lottery winning is inaccurate. The truth is the only sums of money we've come across came after a great deal of hard work. Our journey here started over a decade ago around 2009 while my wife and I worked 14 hour days, seven days per week, at a hair salon we opened in Weston, Florida. The detailed planning of this life started in 2015, and it wasn’t even really within the realm of possibility until late 2016. But everything up to now has happened because of thoughtful daily planning. Of course, we haven't even started sailing yet, but we're near that chapter of this saga, and we'll all find out how it unfolds over the next 12 to 18 months!

In our previous article The Liberties of a Debt-Free Life I mentioned a thing I call "money flow" and I want to expand on this concept because it's this central idea which has guided us to the brink of our new life. Money flow is simply the route your income should take through your personal finance system after it's received. The net effect of this flow (1) maximizes savings, and (2) minimizes costs of living, and (3) eliminates debts.

Generally, your money should flow in the following order, following the concept of pay yourself first:

- Income/Paycheck

- 401k contributions at least up to the employer match (literally free money)

- Some employers will match a certain percentage your contributions to a 401k program - basically free money.

- Contributions to your emergency fund, if it's not fully funded

- Contributions to IRAs (to the max, if you can, $6,000 for 2019 for those under 50)

- Bill and utility payments

- 401k to the max, if you can ($19,000 for 2019 for those under 50), and finally;

- Taxable investment accounts

- Brokerage accounts/index funds

- Long term savings accounts

I'll expand on all of these items in detail below.

Income/Paycheck

There's more to this particular item than meets the eye. It's not just about the absolute amount you're being paid for your labor. Most are cognizant that they should occasionally receive raises or, more importantly, costs of living adjustments (COLAs), they may not be sure how much, or when. Going to your employer and blindly demanding a 10 or 20 percent raise may not get you anywhere.

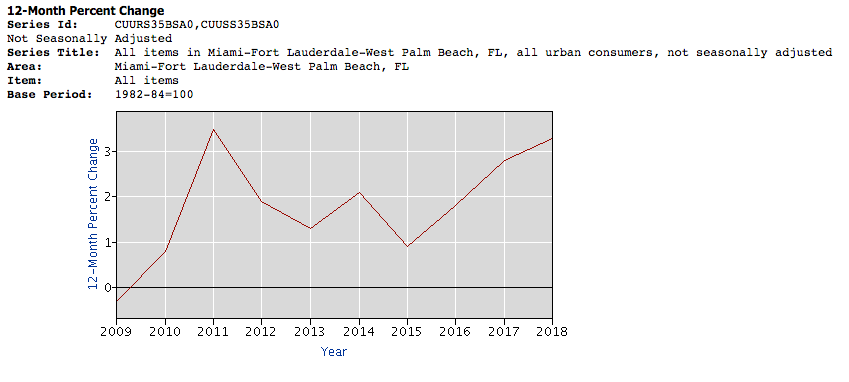

As our economy chugs along (or fibrillates, as it did in 2008), the costs of goods and services generally increase – it's a feature of our economy called inflation. For example, in the early 2000s gasoline for our cars was just over $1.00 per gallon and now that exact same gallon of gas is up to $3.00 per gallon in some places. That's a 300% increase. I could fill my tank on $20.00 at the time, and now that same tank costs me $60.00. This applies to all the things we buy: bread, milk, beer, video games, cars, etc.

If you never get a raise, or even a COLA, what things can you expect to afford in 5-10 years if the price of things around you naturally increase in price? If you're currently living paycheck-to-paycheck, you may quickly see how this won't sustain you for very long.

So on this item, it's critical for you to realize wage increases which at the very least are indexed to the annual rate of inflation in the US. Bear in mind, of course, that your area may experience a greater amount of inflation – in which case you should seek a wage increase of the local rate of inflation. The US Bureau of Labor and Statistics publishes data down to the major metropolitan level; find yours.

If you haven't seen a wage increase in the last year for a modest 2-5%, open a dialog with your employers about such an adjustment. Otherwise you're effectively working for less and less money each year. If you've gone much longer than that in between wage increases, and recent –clearly articulated– attempts on at least the basis of a COLA are declined, consider seeking a new employer.

If you are in an even more dire situation, where your current level of income isn't even providing your basic needs (food, water, shelter, heat, and basic transportation), you've really got to consider getting a new job, or picking up additional work until you get things under control.

401k Contributions

Not all jobs offer 401ks, and while disappointing, that's ok. You may likely still be eligible to invest in the cousin of the 401k, the IRA (more about those later).

I used to think that 401ks were something only the very wealthy could invest in; that 401ks were financial products far beyond my means. I was very wrong. If you have a 401k available to you – you need to invest into it.

Let's demystify 401ks: A 401k is basically a brokerage account (a place to buy and sell stocks, ETFs, and mutual funds) where you and your employer send tax advantaged money (money sent to the program is not initially taxed). Each program is different, some have only a few specific funds you may invest into, others offer a larger selection of target funds and other mutual funds, and some may even offer individual stocks. The money you invest is eligible for withdrawal after you turn 59-1/2 (or 55 in some cases).

As a portion of your income flows into this program, your employer may offer a "match" and it's especially in this case where you should make contributions. Sometimes it's a straight match, sometimes it's a fractional match, but the bottom line is that your employer is effectively giving you more money. Albeit, you don't get to touch this money for 30+ years – the good news is you don't get to touch this money for 30+ years! If you've selected a fund which performs well over your investment period, you'll be rewarded with a nice fund from which you can draw money in your golden years without having to work.

Emergency Fund

If you do nothing else – build your eFund.

This single strategy alone will defend you against nearly all manner of unexpected expenses, and the repercussions of falling into a debt-trap. You are in a debt-trap when most –or all– of your income goes to service debts, usually in the form of loans, or especially revolving credit (credit cards). Since you spent your money to pay for credit and you still need to eat, you then go to the grocery store (or restaurant –eek!) and pay for that with a credit card. Absolutely dire.

I advocate for building up 3-12 months' worth of normal household expenses in a long-term savings account. Obviously the larger your cushion, the longer it may take to fully fund – but it only takes one unexpected expense to really see its value. Until your eFund is full, any extra income –like tax refunds– should be diverted to your eFund after taking advantage of any tax-protected accounts, if applicable. Long-term savings accounts usually have a restriction on the number of outgoing transactions. Their most attractive feature is that they pay substantially more than regular checking accounts. As of this writing, Ally bank offers 2.20%. Generally, the only money you should have in your checking account is the money you will need for your current bill-pay cycle, plus your chosen account buffer ($500-1000).

Your eFund functions as a financial buffer for larger unexpected expenses like car repair, dental or medical issues, loss of work, or even for money you can "lend" yourself to cover moving expenses to take advantage of either a lower cost of living (COL) or advantageous promotion or raise at work. At no point should the money in your eFund be used to pay for non-essentials, tempting as it might be. Like anything in our lives, finances require discipline. You'll have financial freedom, but it comes at reasonable costs.

IRAs - Individual Retirement Accounts

IRAs are like a 401k-lite, with the distinct advantage that they don't require employer participation. There are a few different types, Traditional and Roth being the two most common. As of 2019, the maximum annual contribution for people under 50 years old is $6000. Traditional IRAs are tax-deductible (aka deposits are made "before [federal] taxes") and the earnings accrue tax-free until withdrawn, when they are taxed at the applicable income rate. Roth IRAs are funded with post-tax dollars, will usually grow without accruing any tax, and the withdrawals usually won't have tax associated with them.

There are additional important details to IRAs that you should read about – the most important one is that Roth IRAs have an income limit; if you earn too much, you may not be eligible to contribute.

Bill and Utility Payments, et al.

This entire concept will all be for naught without an adequate and concurrent bill-paying system. We might be debt-free, but we're not expense-free. The goal is to invest generally no more than five hours per month paying bills and addressing movements of money; that's a little more than one hour per week, or ten minutes per day. Can you find ten minutes per day to increase your wealth? I sure as hell can. You're welcome (and encouraged) to spend much more time than that, and at the beginning you will – but it gets easier, I promise.

There are only –and exactly– three areas of personal finance you'll keep an eye on as it relates to bill and utility payments (and savings, by extension); each represents either the past, present, or future of your money. The primary, and most important two, are tracking past expenses (tracks your history of expenditures) and balancing your checkbook (tracks current expenditures). The third, and optional, is a budget (tracks future expenditures).

On the designated day of the week (I prefer payday, and the same day during the week between paydays), prepare to pay your bills by sitting down and inputting your bank balance into an electronic checkbook balancer. I recommend using a spreadsheet. It's basic function should be:

Bank Balance

- (minus) bills/payments/savings/checking acct buffer/etc.

= (equals) Future available balance

The goal at the end of this sessions is to have a future available balance equal to or greater than zero:

| Bank Balance | $3000 |

|---|---|

| Money to Savings or eFund | $250 |

| Electric | $100 |

| Gas | $75 |

| Water | $75 |

| Acct. Buffer | $1000 |

| (Bank Bal - Utils = $1500) | |

| Balance Remaining | $1500 |

First, notice that the "money to savings" line is the very first thing: to quote George Clason in The Richest Man in Babylon: "Pay yourself first."

After that, pay the things you're obligated to pay lest your electricity would be cut off. If you are trying to pay down a credit card, put in more than the minimum payment, if you can and continue. If you can't make the minimum payment, you may dip into your account buffer.

Once these payments are made, and your Future available balance is not negative, you can move forward. If you have a surplus here, send that to your savings.

Then, we come to tracking the history of our expenses, which is tremendously useful for predicting not only a rough estimate of next month's payment, but magically will help you calculate your expenses over the course of an entire year. We'll refer to this as your secret number.

I use (you guessed it) spreadsheets to keep tabs on this data:

| Jan | Feb | Mar | Apr | May | Jun | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electric | 1 | $56.00 | 1 | $59.00 | 1 | $59.00 | 2 | $60.00 | 1 | $62.00 | 1 | $79.00 |

| Gas | 7 | $79.00 | 7 | $79.00 | 7 | $77.00 | 7 | $65.00 | 7 | $55.00 | 7 | $50.00 |

| Water | 14 | $45.00 | 14 | $45.00 | 14 | $48.00 | 14 | $45.00 | 14 | $59.00 | 14 | $65.00 |

| Credit Card | 15 | $1,250 | 15 | $2,000 | 15 | $1,000 | 15 | $1,125 | 18 | $2,000 | 15 | $1,125 |

Obvious data are the column and row headers, and the expense info. The other digits represent the day of the month on which the bill was paid. In the case of the credit card, it should be the "Total charges" line from your statement on the statement closing day. Often you'll backfill that data sometime during the month following. This is only a six month sample above; your sheet should list all twelve months. There's no real need to keep track of historical data for more than a year, though you could do it if you want. At the start of the next year, simply clear the values for January and start over and overwrite the next month's values as you move on. This way you're not messing with your averages too much.

Next, you can total the rows and columns for month-by-month totals, and year-by-year totals for any given item. You can then total up all of the monthly totals to see what your annual expenses are. And now you know your secret number! This is the total number of dollars you need each year to live the lifestyle you currently live.

By knowing what are your annual and monthly expenses, you'll be far better equipped to budget or plan to reduce your expenses and finally live within your lifestyle.

This will also help you build a budget to project your expenses for the coming months or year, but honestly building budgets is not a personal strength of mine. So long as I meet my savings goals, I rely on tracking my expenditures and adjusting on the fly.

Maxing out a 401k

Strive to max out any tax-advantaged account every year, if you can. At the very least, put in what you can, especially up to a company match, if your company offers one. Consider it the cost of youth so you can really enjoy your golden years. As of 2019, the 401k maximum contribution for folks under 50 years old is $19,000, or $1,583 per month.

If you're fortunate enough to be in such a place to max out your 401k at the very beginning of the year, it might be worth your while to do so since now your investment will make money on the full amount all year long.

Taxable Investment Accounts

Finally, the last stop for your paycheck will be any other taxable investment accounts. If you've got any dollars left over – now's the time to take advantage of dollar cost averaging in your brokerage account, or tucking away even more money into your eFund. By this point you can tuck this money nearly anywhere, or even spend it, but saving it anyway is really a good idea.

Do you have specific questions you'd like to get some help with? Subscribe below and simply reply to the welcome message. I'll try to get some insight into your situation and provide some basic guidance.

Header image by Mohamed Nohassi via Unsplash