How It Got To This Point

My wife, two children, and I plan to sail around the world in 2020. We've spent too much time working and not enough time enjoying the rarest commodity of all: time with each other.

My wife, two children, and I plan to start sailing around the world in 2020. We've spent too much time working and not enough time enjoying the rarest commodity of all: time with each other.

At first

Growing up, we weren't wealthy; we weren't destitute, either. I was fortunate to never have to do without and we occasionally enjoyed the perks of having "extra money" like traveling, gifts, or dinners out. I try to be cognizant and humble of where I started.

My parents were diligent in reminding me to "save money". They parroted to me what they had grown up being taught. My mom especially tried her best to help me put away even just a few dollars every pay period from my high school jobs, and I did make half-hearted attempts to do that after I moved out on my own. At the time, I didn't understand the broader plan for why that sort of thing is important. I either didn't listen, or wasn't told, that there is a really good structure to personal finance that can set one up for life after just a few years. I had no long-term goals. Tomorrow didn't matter, because right now was all I could conceive. I had a profound lack of financial knowledge save for my parents' insistence that I not get into credit card debt, and a very important credit management class I took in high school JROTC.

Becoming an adult

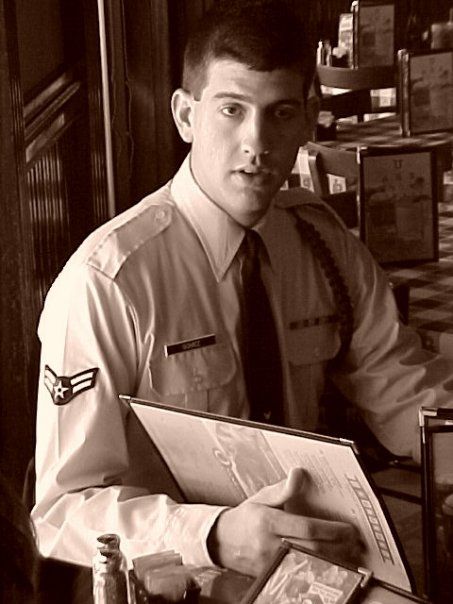

I imagined a future where I would follow and then exceed my grandfather's footsteps. He joined the US Army Air Corps (predecessor to the US Air Force), and later became a civil commercial pilot, though he never made a trade of it. I planned to not only do both of those things, but to become a pilot in the Air Force. And I'll do it from the ground up; I'll enlist first! What a romantic idea.

Basic training was a breeze after four years of JROTC, and now I was making the "big bucks". High school jobs couldn't hold a light to this kind of money. I could buy nearly anything, after I checked with my mom first, of course.

About two years in, I financed a new car, a 2003 Jeep Wrangler Rubicon. The top of the line. Only $430 per month, for 72 months. Mom coached me on how to negotiate to get the payment down from $450, otherwise I wouldn't be able to afford it. I'd have to make some sacrifices in order to pay for this every month. No more Burger King for lunch and dinner until I get promoted, I guess

On one assignment to the Philippines in 2005, I met my wife, Shiela. Endlessly patient and charismatic, I knew I wanted more time with her, so we made the arrangements to move her to the US with me. What a leap of faith she made! My mom confirmed with me I had the finances to cover those expenses.

By the time I got out four years later, I still hadn't taken the responsibility of reconciling my personal finances. Things went this way for a long time. Too long. Early 30s long, I'm embarrassed to admit.

When I left the military in January 2007, the US economy was doing tremendously well. There was little risk in joining a new business based on luxury leather car interiors. None at all. Shiela and I moved into our own apartment, too. We wanted something larger, but mom relayed to me that $750 per month was all we could afford.

Living paycheck to paycheck and having my mom manage our finances had become so normalized by this point, that we were unable to imagine any other way of managing our marital finances. When I was forced to closed the luxury leather car interior company in October 2008, I had to get a "real job" working for someone else. Did my mom help me make sure my wife and I could afford the things we wanted during that transition? You bet your ass she did.

My wife and I opened a hair salon in 2009; guess who was our CFO? My mom. We bought a house in 2012 - how did we know we could afford it? My mom. I started flight school about then, too. Did my mom help me figure out if I could afford that? Actually, no - it was (gracefully and mercifully) paid for by the Post 9/11 GI Bill, the predecessor of which I was ordered to volunteer to invest into when I first joined the military (by my Military Training Instructor, my mom away from mom). That $100 per month investment ($1200 total) was such a fortuitous thing to happen.

All the while, my wife and I developed quite the dining out habit. If I recall correctly, at one point we were up to $2000 per month dining out. It partly made sense because with running the salon, we were working so much and were so exhausted by the end of the day that neither of us wanted to cook.

In 2013 we had our first baby, Maya - mom made sure we could afford all that. Shortly after, in 2014, I became a flight instructor and professional pilot, and then landed my first "Big Boy Job" in 2015. On one of those work trips to pass some time, I started watching sailing videos from some of the more famous YouTube sailors: Delos, La Vagabonde, White Spot Pirates, Uma, and Shaun & Julia. Things seemed to be going well, even though I still really had no idea what my financial position was.

Then, in 2016, I ran into serious medical trouble: I herniated a disc in my lower back.

The tipping point

After I arrived at home in Florida to prepare for the birth of our second child, Cyra, I noticed a stiffness in my back that was only assuaged by haunching over, like an old man. At first it lasted only for the first few hours of the day and I could stand up straight by evening. But then in the span of about one week, it lasted longer and longer, until one morning I was unable to sit, stand, or walk without excruciating pain. All I could do was remain laying down.

Now, when our bodies are injured, our minds seem to try to reduce the pain by compartmentalizing it, basically separating it from our bodies. It's relatively easy when it's a hand or foot, but as that pain draws nearer and nearer the core of our bodies, or our heads, it becomes unavoidably centralized. And such was my predicament. I had the equivalent of a white-hot barbed knife in my lower back which also radiated pain down my left leg. Sitting, standing, and walking were impossible. "Walk it off" a younger me would have said. "It can't be that bad" I imagine some of you might think. Well, let me tell you: It. Is. That. Bad.

There really are not any words I can use to describe the pain, so a gestalt will have to do: It wasn't for a lack of desire or motivation that I couldn't walk. It wasn't because I wasn't hungry that I couldn't sit at the dining room table. It wasn't because I was simply imagining the pain that I –a 260lb, 6-foot tall, 32 year old man– would cry myself to sleep at night. It's because it fucking hurt. Imagine a pain so central and connected to the other parts of your body that the only small respite from it was laying down on a futon mattress in your living room eating pain pills every four to six hours so you could at least be closer to your family during the day. For about two months.

Before those two months, as I've hopefully illustrated, I never pondered my future. I never considered what life for my wife and kids would be like without me. I never worried about money because I believed I'd always be able to earn it; until I became temporarily handicapped.

My older daughter kept me entertained a lot, and we watched a great deal of Adventure Time together (one of my absolutely most cherished memories). I had schoolwork to do, I renewed my flight instructor certificate, planned my medical care, and submitted for disability benefits. In between those things, I found hope through watching my favorite YouTube sailors, and reading of my friend Tara and her husband Mike's travels. Their varying courage in the face of uncertainties, their joys at making landfall in beautiful tropical oases, their dreams of maintaining an endless summer vacation was my call to action. If I want to do those things with my family, not only do I have to heal, but I must completely and utterly understand our financial position. With two children, that kind of life change cannot be accomplished off-the-cuff.

But, the looming question at the time was, will I walk again?

To walk again, physically and financially

The US Veteran's Administration catches a lot of flak regarding the medical care they provide to veterans. It absolutely can be a challenge to get seen, and quality of care varies from facility to facility. Despite the pain I was in, I tried patiently and calmly to call the people at my local VA healthcare facility to get the soonest appointments I could nab. Even same-day appointments were not out of the question, as it meant moving through the system much quicker. I hobbled my broken body outside to catch an Uber once, that's how committed I was to get to the VA hospital.

In the end, several things aided my recovery: my will, one trip to the VA ER for pain management, two trips to a specialist for hydrocortisone injections, and a full on surgery for a microdiscectomy (removing a small piece of something) and laminectomy (making more space for something).

We take going to bed every night a little for granted. Once I started considering the things that could go wrong under general anesthesia, I became much more aware of my own mortality. It was during this time that I ensured I had my personal affairs in order. In case I didn't wake up.

It was after I returned to work a month or so after surgery, still sore but much better off, that I created our first spreadsheet to track our personal finances. Net worth was the very first thing I calculated. There's tremendous value in knowing what is your baseline. I was taken aback by how much we owed, even though we were in the positive. We've been working so hard but despite the assets we had at the time, it was all going to service the debt we carried from our salon, giving birth, and two cars we financed. We shouldn't be indentured to our debts, though some of us do so with glee.

So we sold the salon, the house, and traded in the lease to buy a beater (oh gosh a story for another time). We were lucky someone was willing to continue our dream of running the salon; we'd had our fill, while the house was really a fortunate –albeit unintentional– market timing. We paid off the credit cards and other loans to realize for ourselves an actual net positive financial position.

And may I tell you? It's fucking amazing.

Fucking amazing

Being debt-free is, on its own, liberating. Pair it with frugal living and enough savings to cover expenses for just a few months and then that power is multiplied to being able to do what, and go where, you feel is needed for the next step in your life.

If I've kept you this far, I hope you'll remember I said "I try to be cognizant and humble of where I started." And it's true. I understand that everyone has a different starting place, while others have a different destination. All of life is a numbers game and for some, starting over won't be possible, while for others maintaining a certain lifestyle also won't happen. But the fear of either of those things is no reason not to try. Work towards a life where you're not slaved to a workplace for fear of not being able to pay bills.

The principles of the kind of life where you're free to move about your motivations are simple, regardless of our individual abilities or station in life to achieve or maintain them: Earn as much as you can, spend as little as you must, and save and plan for the life you want.

About my parents, and a note about my mom

There are no larger motivators or cheerleaders in my life than my parents. Every single thing I've ever been able to accomplish is because of these two. They have sacrificed more than I will ever comprehend, and I have only a shimmer of a hope that I can be the same kind of inspiration to my own children.

My mom is the first of only two women to put up with me, and I'm notoriously obstinate. Shiela, my wife, is the other. I often wonder why they both put up with me.