The Liberties of a Debt-Free Life

By living without debts, you are empowered to make broad life choices, including picking up and moving anywhere, changing jobs, and buying things, without deep financial hesitations.

What does it mean to be debt-free? What are the benefits of being debt-free? Can I still "have fun" and "splurge"? How do I get started?

What does it mean tomorrow be debt-free?

While the literal definition of being "debt-free" means not owing a single cent to another – the modern, and more pragmatic, definition of being debt-free means the financial state of being where one could pay-off all current debts, and remain in a comfortable financial position.

By my mid-twenties, it started becoming painfully obvious to me that I needed to take control of my finances. Although I started paying more attention to basic personal financial information in general, the truth is the only take-away I managed at the time was that I should aim to be "debt-free". It was a nebulous idea with such a distant payoff that these concepts simmered (read: I procrastinated) for nearly ten more years before I finally took action.

On that first day, I sat myself down and started reading through the Bogleheads Wiki which provides basic personal finance and investment advice inspired by Jack Bogle, the founder of the investment titan Vanguard. If we are to see farther, it will be by standing on the shoulders of giants.

Our individual journeys will vary. Some might start very near to being debt-free; others will start quite far. The important thing is to make some kind of progress at least once per week towards this goal, literally no matter how small, and by nearly any means. If you never learned these basics while you were younger, it will be a challenge akin to a new subject in college. Rest assured, there is plenty of information online and in libraries, all with different methods of presentation which will help you to grasp every facet of personal finances.

What are the benefits of being debt-free?

Without debts, you will clearly see where your money flows. Rather than paychecks disappearing into non-specific credit card payments or restaurant tabs, you will track your money from payday to your savings accounts, and as a result, your savings will grow. Having a robust emergency fund is a key achievement in living debt-free. Having 3-12 months' worth of normal household expenses in savings is the signal that your money flow is correct, and having this sum of money available to you will be one of the most liberating things you've ever experienced. Having such a fund means that you can stand a loss of income for however many months you've planned without changing your current lifestyle.

Imagine this:

If you're at a job or a place in your life you don't enjoy right now, what's the first thing you'd rather be doing? Where else would you be? What project would you work on? Which language (either spoken or programming) would you study? What new trade or skill would you want to pick up? Who would you go to meet? Where would you volunteer?

If you're sick of the city and long for a simple country life you can move with nearly as much or as little notice as you'd like. Unexpected car repair? Use the transportation option of your choice as your car is in the shop – you'll even be able to get the cash price for the service. Laid off? Laugh out loud while you ask your now former employer what your severance will be – even if you're not entitled to it.

By living without debts and having a robust emergency fund, you are empowered to make broad life choices, including picking up and moving anywhere, changing jobs, and buying some things, all without deep financial hesitations.

Can I still "have fun" and "splurge"?

Of course - and what kind of life would it be if we didn't? The occasional purchase or splurge is just fine. Just don't make excuses to find every occasion or splurge, else you'll soon be back to where you started! Additionally, there's a couple of things to keep in mind: If you're working, how many hours would you have to work at your current pay rate in order to "pay" for the fun or the splurge? Don't rely on tax refunds or windfalls to cover the gap. Second, if you're not working, how much sooner would you have to return to work, or how deeply will it cut into your savings as a result of the expenditure?

By framing your finances in this way, you develop a deep reverence for either your time, or your emergency fund and you won't likely take either for granted.

How do I get started?

I advocate starting by calculating your current net worth. It's an absolute measure of your current financial health. Your net worth is simply the sum of all of your assets (things worth money, usually worth more than $500 which can be re-sold in a reasonable amount of time) less the sum of all your debts (places you owe money - in total). Use a spreadsheet program, like Google Sheets which is currently completely free and a strong rival to paid options, to help you run your calculations. Here you'll need two to four columns, one for all of your Assets, and another for all of your Debts. On each row, list the account name and type, and the current balance of each. Your sheet can be as complicated or as simple as you want. Example:

| Assets | Debts | ||

|---|---|---|---|

| Checking | $1,500 | Credit Card | $1,500 |

| Savings | $3,000 | Loan | $5,000 |

| eFund | $10,000 | ||

| Car | $5,000 | ||

| TOTALS: | $19,500 | $6,500 | |

| $19,500 - 6,500 = | |||

| Net worth: | $13,000 | ||

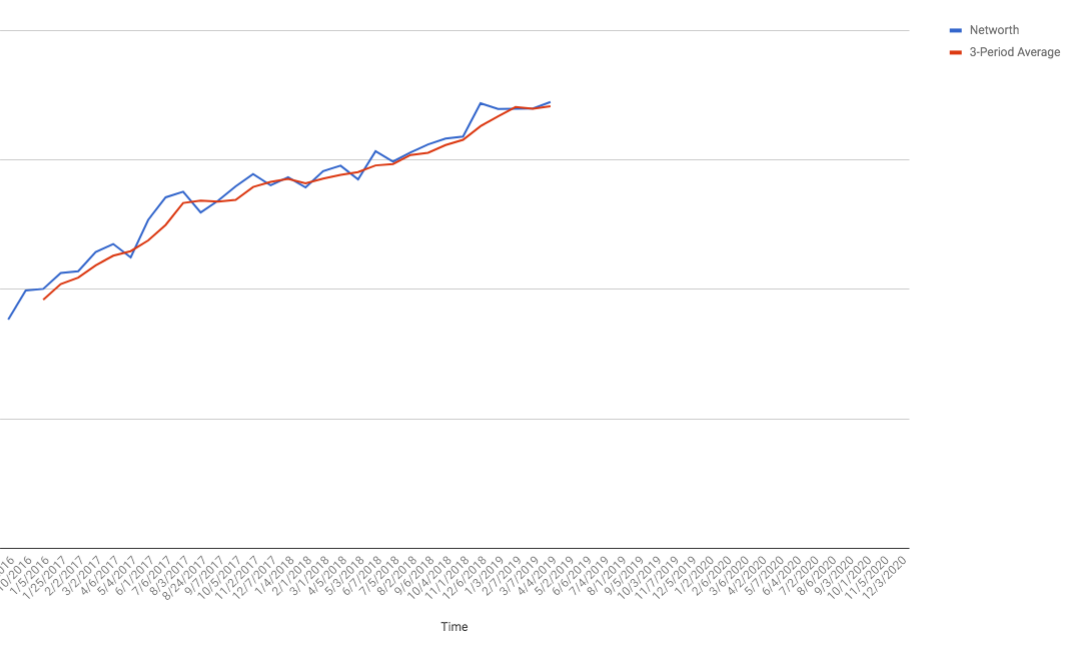

Monthly is about as frequent as you'll need to calculate your networth, but if you're looking for fine grain detail, weekly works, too. Depending on the number of accounts you have, though, weekly could be burdensome. Feel free to add to your tracking sheet averages, sums, or even standard deviations if they're important to you. Whatever helps you visualize your money. On my sheet I keep a log of my monthly net worth updates which sends its data into a graph for easy viewing:

Final Thoughts

Debt-freedom is an important foundation in building Financial Independence. There are many things to learn, and they are relatively easy to understand when you dedicate time to learning them. I only knew how to spend when I first started. When I first started studying these concepts, I had a difficult time wrapping my head around how my money should flow once I earned it as a paycheck. For the record: it should not pass directly to debts!

If you enjoyed this article, you'll really enjoy reading the follow-up article The Big Picture of Personal Finance.

Do you have specific questions you'd like to get some help with? Subscribe below and simply reply to the welcome message. I'll try to get some insight into your situation and provide some basic guidance.